Alex Souto Maior/iStock via Getty Images

Introduction

I originally wrote an article on Good Times Restaurants (NASDAQ:GTIM) back in June 2021. Things were going well until the Q2 2022 report.

-

Beef, labor and delivery are all eating away at GTIM’s margins as we experience an inflationary bout.

-

The Q2 2022 restaurant level margins declined by 6% YOY from 18% to 12%.

These problems are not unique to GTIM and they sum up the Macro environment for restaurant industry as a whole.

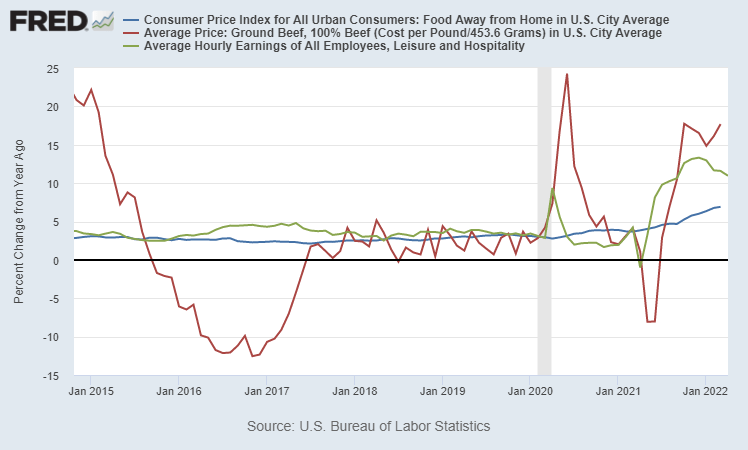

Source: FRED

The blue line in the chart above shows the increase in prices that restaurants have implemented while the green and red lines represent labor and commodity costs. Labor and commodity costs have risen above the price increases for restaurants thus squeezing margins. Most restaurants in Q1 2022 reported much lower margins YOY.

The Stock price for GTIM has reflected this going from a high last year of over $6 to $2.64 a share at the time of writing. The market is clearly aware of these difficulties and investors have sold off the shares accordingly. The question is what will happen going forward.

For the next year restaurants such as Darden, BJ’s, and Brinker are forecasting around 10-15% commodity inflation over last year and around 6% labor inflation for the year. While restaurant menu pricing will more than likely be at or higher than labor inflation. I don’t see pricing being higher than commodity inflation. This will lead to lower margins for the restaurant industry as a whole.

This too shall pass!

The current inflation is a supply based problem and there are a number of indicators that show improving trends in supply. These indicators are either above pre Covid-19 highs or have bottomed.

These include

I think the best indicator for the food industry though is Tyson’s capacity utilization for various meat products. Meat is the largest food expenditure for restaurants and Tyson (TSN) is one of the largest meat processors.

|

Tyson’s Beef Production per Week (Unit=Heads of Cattle) |

|||

|

Fiscal Year |

2021 |

2020 |

2019 |

|

Production |

120.9K |

119.350K |

131.75K |

Source: Tyson 10K’s

Production was improving until Q1 of 2022 due to the omicron, the Russian invasion of Ukraine and the China lockdowns. However, I do think this is the bottom and it should be all improvement from here. Production should reach 2019 levels for Tyson in the back half of 2023.

Once production levels for food reach 2019 levels they will most likely overshoot demand leading to a favorable commodity price market in 2024-2025. If you don’t think so then Tyson would probably be the better bet. If you agree than that means the name of the game for restaurants is surviving the next year or two.

Survival

GTIM should be able to survive due to the following

-

GTIM even with the suppressed margins is still generating operating cash flow. Total cash on the balance sheet only declined YOY due to investments. If GTIM curtailed new restaurant expansion they would have an increasing cash position.

-

GTIM has a cash position of $7M with $1.4M in receivables.

-

GTIM has no debt currently and has a line of credit of $8M that they can access.

If margins continue to decline, however, GTIM could be faced with negative operating cash flow. With the cash and liquidity currently in place GTIM should be able to survive the 2 years necessary to get to a more normal environment.

However, there are a few reasons that I think GTIM restaurant margins should at least stay the same or even improve.

These include

-

Per Q2 2022 management call GTIM management said they were less aggressive on pricing than competitors. This means they may be able to increase prices more aggressively going forward to protect margins.

-

Foot traffic was below normal levels in Q2 2022 due to omicron and have yet to recover from pre Covid-19 levels. Higher volumes going forward will increase sales leverage and thus margins

-

GTIM is currently in a lawsuit which I estimate is eating up $500K to $1.5M in expenses a year. Once this resolves later this year GTIM will be able to lower G&A expense

-

In 2021 approximately 33% of all sales were delivery/take out. These sales tend to be lower margin than dine-in due to DoorDash (DASH) taking a sizable fee. As delivery/take out sales normalize to pre Covid-19 levels this will increase margins. I estimate the cost savings to be between $1M – $2M.

Once GTIM can return to a more normal environment then management can continue to execute as they have since 2015. I already wrote about this but I’ll give some highlights.

Highlights

-

G&A as a percentage of Revenue has declined from 14% in 2015 to 9% in 2021

-

Bad Daddy’s, their main restaurant, has grown its store count from 12 to 39 stores since 2015. With 2 more being built this year.

-

FCF Margin as I define it has grown from 4.5% to 7% since 2015

-

Net Asset Turnover has consistently improved since 2015.

-

Bad Daddy’s Restaurant has excellent unit economics of between 25-30% Cash on Cash Returns

Conclusion

Overall, I think the current restaurant stock prices are pricing in the current environment baring a recession. I think the worst is over in the restaurant industry and GTIM is a buy at the current price. GTIM should be able to survive and then continue its growth.

Risks to the Bullish Thesis

-

Inflation does not moderate next year. More supply chain shocks could cause this.

-

GTIM needs to raise equity. They were able to avoid this during covid but we’ll have to see if they can steer the ship safely.

-

Restaurant level Margins decline below 10% and stay there with no hope of improvement.

- Recession !!! Which I don’t think likely due to the 10Y-3M yield curve not inverting.